Like their fellow Americans, California homebuyers are objecting about the exorbitant cost of real estate.

The main distinction is that California’s rejected homes are far more costly than the average home in the United States.

Please put the buyer’s market vs. seller’s market argument that many real estate influencers propagate out of your mind. In essence, no one is enthusiastic about this market, making it a nobody’s market.

And declining housing values would be the best remedy.

Let me explain using a study of April sales that Attom tracked using my reliable spreadsheet. These numbers represent the most comprehensive picture of homebuying available, including concluded sales of both new and existing homes, condominiums, and properties. Information dates back to 2005.

The numbers for April were not good. California’s April sales were the fourth worst in 21 years. seventh slowest in the country.

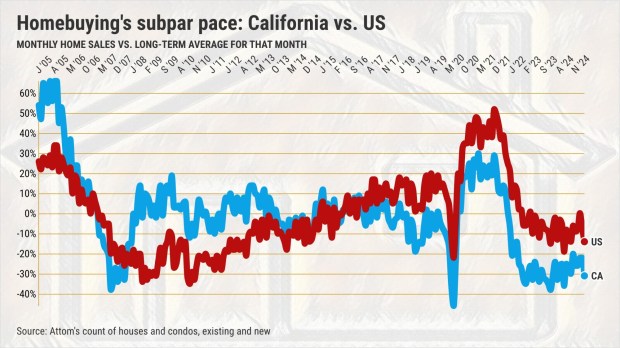

California’s sales have increased by 2% in the past year, while the U.S. has seen an 8% decline. However, observe where those fluctuations depart from the corresponding markets.

California’s April sales were still 23% below the 21-year average for the month. For the 35th consecutive month, the pace of home purchases fell short of the historical average.

At the national level, it’s slightly less sour: 24 of the last 25 months have been below par, and April was just 10% below par.

Look, the same person is to blame: exorbitant costs.

California’s median sales price increased to $750,000 in April, a mere 1% increase in a year. That matched a June 2024 record high.

Over a 12-month period, prices nationwide increased 4% to $364,000. The all-time high, which was also set in June 2024, is just $1,000 away.

A decrease in the number of people paying more for any item indicates that demand has dwindled to mostly wealthy people who can afford to be mistaken about the market.

Think of exorbitant prices combined with the confusion surrounding interest rates that springtime purchasers have had to deal with.

In the three months ending in April, the 30-year fixed-rate mortgage averaged 6.7%, down from 6.9% in the same period last year. However, rates were 4.3% six years before to the epidemic upending the economy.

This corresponds to an expected monthly payment of $3,888 for a California buyer purchasing a home at the median price in April. This assumes a 20% down payment and does not include insurance, property taxes, or perhaps homeowner association dues. Oh, and in order to obtain a preferred rate, a $75,000 down payment is required.

Amazingly, in just six years, this housing expense metric has increased by 97%. Double, indeed! Smaller data tell a very similar story across the country.

The average American buyer in April received a monthly payment of $1,887. In six years, that has increased by 108%. At least the average down payment in the United States is merely $36,000. Only, yes.

Yes, a short-term solution would be reduced mortgage rates. However, do you think mortgage rates will return to their 4.3% level from April 2019?

If they did, California homebuyers would still have to deal with 50% higher prices, compared to 58% nationwide during the same six-year period. In the same time frame, average weekly wages increased by 29% nationally and by 25% in California.

More expensive new homes or more expensive existing homes on the market won’t close this kind of affordability disparity. Experts in real estate predicted that when inventory rose, homebuying would increase. Despite having more options, homebuyers continue to say “no, thank you!”

If builders or sellers don’t take action, the demand will remain sluggish. Call it rewards, modifications, compromises, or anything else that calms the soul.

Simply lower pricing while considering what your favorite retailers do when they are faced with undesired or mispriced merchandise.

The time has come for houses to go on sale.

The Southern California News Group’s business columnist is Jonathan Lansner. His email address is [email protected].